The road to hotel recovery 2020

Here’s a take on how hotels and the broader travel industry will reopen during COVID-19 aftermath.

Interestingly, 68% of consumers feel safe in their cars, according to the MMGY Travel Pulse. This could suggest an early resurgence in drive-market travel when a rebound occurs.

About 40% of consumers feel safe in parks, 11 points higher than grocery stores. This bodes well for outdoor travel – “especially those tied to national and state parks,” according to MMGY. Business travelers show more signs of confidence in safety than leisure travelers in venues like hotels, air travel, rail and events. While most assume millennials will be the first to adopt travel again, 49% of travelers that are 50 to 64 years of age show the least concern for their safety than any other age group, according to the Travel Pulse survey.

Leisure travel

Hotels will have to prove they are safe by promoting their safety and cleaning protocols. The leisure market is made up of pent-up demand from travelers who are antsy to travel, even if it is a short drive to another destination. The destinations with lots of outdoor activities will likely recover faster than others, and with cheap gas, those “drive markets” close enough to major metro areas will see success. The leisure market is the most likely to recover first and that might be as early as Memorial Day weekend if travelers feel it is safe and government officials have cleared the way for destinations to be open to guests.

It will be interesting to see what, if any, impact this has on events such as weddings and other social events including consumer trade shows. The real question will be, are these travelers ready to hit the road Memorial Day weekend or will they have to wait for Fourth of July weekend or later?

Corporate travel

Self-employed corporate travelers will travel first. As corporate mandates loosen up, large corporations might allow sales executives to travel, but might not require them to travel due to fear that they will be sued by employees who get sick. There is also the possibility that for a while, technology will replace some corporate travel and video calls might replace some travel. Back in 1981, there were rumors that this was going to occur because the technology was there, but it was never able to gain traction as a replacement. Times might be changing at least for the short term, but as indicated by MMGY, these travelers are not afraid of travel.

Group travel

The group market will take a while to recover. Most conferences and conventions scheduled through June have already been cancelled. July and August are in limbo, but most meeting planners that I have talked to are comfortable with this fall. The corporate market normally falls off in mid-June and resumes in September, which affects corporate group travel. That pattern is likely to continue, but there are many variables that will drive group travel. Sponsors and vendors must support meetings, attendees must be willing to travel. However, it is likely attendance will be down this fall. That said, there might be even more meetings this fall as Q2 events were largely postponed and might reappear before 2020 ends. If this comes to fruition, it will end up with a saved year compared to what might happen if the pandemic returns after summer.

The bottom line

Regardless of what occurs, average rates will not be what they were this year. That window has closed.

The truth is science may tell us that it is foolish to travel. But, this particular science has not really been tested in modern times, unless we consider 1918 to be modern. The American traveler is savvy and not foolish but if there is a treatment and testing and if the curve has truly been flattened, most likely there will be travel this summer. Occupancy levels will still be down markedly for 2020 and unfortunately for hoteliers, the savvy consumer will be shopping for discounts.

STR’s Jan Freitag said he expects a strong rebound in 2021 and 2022, but his assumptions are that RevPAR will still be 35% to 40% below 2019 based on a year-over-year comparison, and near 15% below 2019 in 2022. Most of these numbers are caused by a combination of excess supply growth and soft demand growth. To a quick and safe recovery! (STR is the parent company of Hotel News Now.

)

Original article on Hotel News Now can be found here.

Will better unemployment benefits hurt efforts to reopen the economy?

Bob Rauch, R.A. Rauch & Associates

NO: While COVID-19 threw our government into crisis mode, those who value their unemployment checks more than their jobs will not be missed. The economy remains virtually shut down in California — there are only a few sectors of the economy where there is more demand than supply for workers. In most cases, employees who have been furloughed want to come back to work because they are not lazy or short-sighted.

Read full article by Phillip Molnar here.

Hotel Industry 2020 – The New Normal

Click here to read the accompanying article.

Click here to read the accompanying article.

Hotel Industry 2020 – The New Normal

Welcome to the Twilight Zone or the surreal existence of those of us in hospitality with empty hotels. They are slowly and not so surely picking up but we will return to a “new normal” soon. What will it look like? The “light and warmth of hospitality,” coined by Conrad Hilton, will not be apparent upon entrance to a hotel post COVID-19. Expect acrylic covered front desks, masks and gloves, signage advising guests to use caution, frequent disinfecting of public spaces, wide open lobbies with limited seating and restaurants and bars that have six feet of separation in every direction. The good news is that we are approaching the re-opening of the economy!

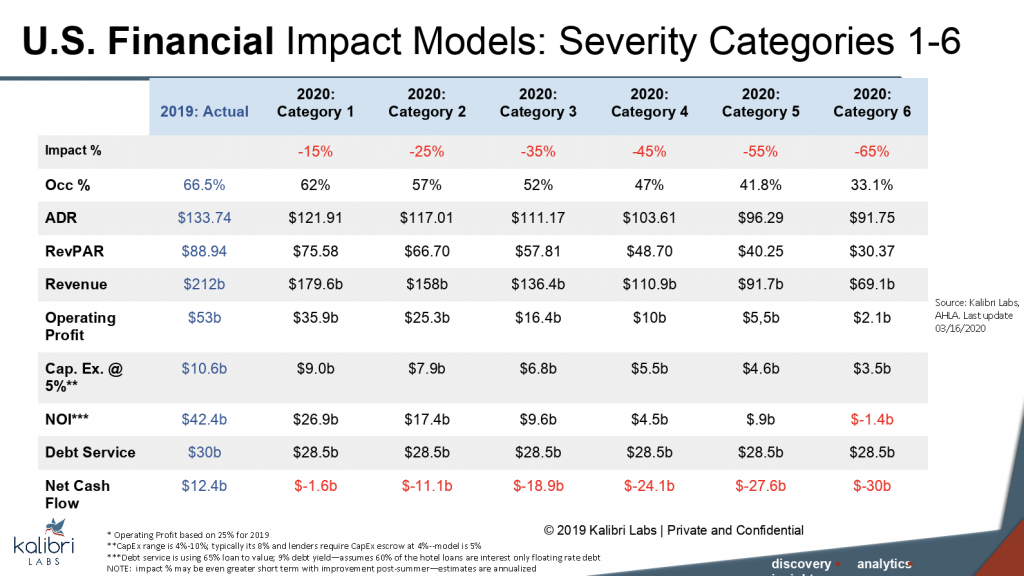

According to the top prognosticators in the hotel industry, here is what we are looking at from an occupancy, average rate (ADR), RevPAR perspective:

| CBRE | HVS | STR | Kalibri Labs* | Average | |

| Occupancy | 42.6% | 43.1% | 37.9% | 49.5% | 43.28% |

| ADR | $109.98 | $111.61 | $112.91 | $107.39 | $110.47 |

| RevPAR | $46.85 | $48.15 | $42.84 | $55.25 | $48.27 |

| Release Date | April 23 | April 27 | March 30 | April 29 | n/a |

*based on six Impact Models: Severity Categories 1-6, average of Category 3 & 4 – the entire model is included at the end of this article

The best case seems to point to a drop in occupancy from 66% in 2019 to 50% in 2020 and a drop in ADR from $133 to $107 resulting in a RevPAR drop of over 30% from $88 to $55. Worst case scenarios have us dropping well below 50% in RevPAR, close to Armageddon. Once STR releases an April forecast, the overall average should increase. These firms have done a tremendous job of analysis given the completely different demand generators—the bad news here is that even in the best scenarios, there are no net profits forecast for 2020.

Operations

From an operations perspective, labor costs may contract as operators flatten organizations to eliminate middle management and reduce paperwork, freeing up senior management to interact with guests like hospitality should be. Operating costs may increase as we sanitize and disinfect religiously. Profits will be gone in 2020 with hopes of a return to closer to normal revenues and profits in 2021 or 2022. The implementation of completely new protocols including hospital grade sanitization, masks and thermometers will be fairly expensive relative to supply costs.

Valuation

We can expect values to decline in line with net income, but with less deals done. The real question will be when will values come back to 2019 levels and will it be a buyer’s or seller’s market. The latter depends on how long it will take for this destabilized market to bounce back. Over-leveraged sellers will be at risk as short-term values will take a precipitous drop. However, lenders will only foreclose on operators who do not engage in a sincere way. They do not want to own hotels. Transaction volumes will be down according to an April, 2020 Lodging Industry Investment Council survey.

Supply

Airbnb and short-term rentals will continue to impact hotels. With unemployment numbers at new highs, millions of Americans will need to find a way to supplement their income and home sharing may be people’s means to do so. New supply for those accommodations could surge and have a negative impact on hotel room rates in general. But many cities have sued Airbnb and our original prediction was that they would become an online travel agency (OTA) by 2020. Well, only time will tell, but they have postponed their 2020 IPO.

Demand

We will start to see two separate groups emerge – those who feel they can travel freely, and those who are still susceptible to the virus. The first group is made up of individuals who have tested positive for the virus anti-bodies – meaning they had the virus and lived and those who believe they are not at significant risk. This group will be our primary source of demand, while others may continue to quarantine and limit travel. This summer, we can expect to see “pent up” demand. After being stuck at home for eight or more weeks, consumers will be itching to travel.

What’s Next

Clearly, there will be hotel types and markets that will outperform others. Resorts and downtown hotels will have a longer road back and markets that do not have a drive market within 150 miles of them will also have to wait for air travel to return to near normal. Larger hotel brands may seem more trustworthy in terms of their cleaning protocols over smaller boutique hotels, but the American Hotel & Lodging Association has a “Safe Stay” program for all members that might level the playing field. Beach and other outdoor-centric destinations will also reap the benefits of the unquarantined masses. Corporate business is not ready to return and group business is at least 5 months away from a return to near normal.

So, we are in a new normal that will change every month as states adjust and tweak their distancing rules and guidelines for business openings. Those states that understand the balance needed to open safely while protecting the at-risk population will recover much faster than those that are afraid to open anything at all. We can’t be afraid forever – after all, we are not even sure that Sweden was not more effective at handling this than we were. To a safe, smooth opening of the economy into a new normal summer where we can all take a sigh of relief!

By Robert Rauch and Sarah Andersen

Econometer: When should the economy reopen?

Q: Should the economy be reopened in the near future, even if the coronavirus is not completely contained?

Bob Rauch, R.A. Rauch & Associates

YES: Businesses should be reopened with phased levels of protection including masks and physical distancing for all activities. Beaches, parks, trails, golf courses and stores where there is limited contact should be opened now. Restaurants, bars and recreation facilities should have clear protocols with use of gloves as needed. It is time to protect the most vulnerable and then let San Diego residents choose their comfort level with activities. The economy is on life support.

Read full article by Phillip Molnar here.

COVID-19 Overview

ClICK HERE to watch

CLICK HERE to access COVID-19 Information Center for Hoteliers PDF

Updated April 22, 2020 – we will continue to update as the situation evolves

COVID-19 Information Center for Hoteliers

CLICK HERE to access the PDF

Content will continue to be updated as the situation evolves.

Updated April 22, 2020

Hotel News Now – Managing the impact of COVID-19

Original Article on HNN can be found here.

Managing the impact of COVID-19

Hotel owners and operators need to put into place an action plan and then follow the plan during the COVID-19 pandemic.

I have read just about everything that has been written about the COVID-19 pandemic and have some thoughts. One, this is not 9/11, nor is it a typical recession in any way. However, many of the tools we need are similar. The difference is in the quick drop from a strong economy to virtually no hotel demand. Previous recessions or events dropped demand by 30% to 40%. This drop is precipitous with up to an 85% drop in demand. The similarity is that all will be good again; it will just take some time to come up from this bottom.

Since negative news sells, we are blasted with more bad news than good news. Clearly, some of the bad news is caused by the lack of readiness of our healthcare sector. This is not something any hospital alone could have tackled, but it is something for us to consider going forward as a nation. COVID-19 is highly contagious, and this has put fear into our political—as well as healthcare—leaders. I believe that over 99% of people will recover if they are infected and that most deaths will be in those over 80 or with underlying medical conditions. Those are the people we must protect.

To gain traction in the hotel market, we need to get to a point of optimism that we have slowed the spread of the virus using social distancing. The impact of the “shelter in place” orders has crushed hotel demand. When STR finishes examining the autopsy that is COVID-19 market conditions, it will be reported as the worst drop in demand in the history of the hotel industry by a wide margin. This drop also will likely be followed by low consumer confidence, less disposable income and continued health concerns. Ergo, we will have to recover from the true bottom, and that bottom seems to be right about now. Is there a silver lining? Yes. An unparalleled stimulus to an economy that was strong through the end of February 2020 is coming.

So, how do we survive this low? We must preserve cash, treat our employees and guests with the utmost respect and manage harder than we have ever managed before. We need to look inward and reduce costs, risks and exposure. We need to look outward for relief from lenders in the form of forbearance, help from franchisors to extend invoices, breaks from vendors in terms of both pricing and terms, relief from tax authorities and more. It is time-consuming but well worth trying every possible angle, including SBA loans and local bank lines of credit.

Additionally, we need to find new sources of demand from the healthcare sector, universities, displaced office workers who have no office in their home and self-quarantined potential guests. Remember, the hotel industry is a noble profession and is one of the critical infrastructure industries as listed by the state of California and many other states. We help companies and people with important components: shelter, food, safety and comfort. We will find that our facilities will play a critical role in getting this great nation back on its feet.

The bottom line is that there are no days off during a crisis. Tweak your projections regularly from 10% to 15% to 20% and, eventually, we will be back to breaking even where we can begin to rehire all of those furloughed employees. Remember to be thoughtful about how we are communicating with guests. Everyone is going through the same challenges right now, and customers will be quick to judge how we react.

On a personal note, the single most difficult conversation is letting an employee go, whether it be through a furlough or layoff.

Hang in there, and if there is a need for help, reach out to an expert to navigate the waters of cost reduction, demand opportunities and government assistance.

Do not panic—this is not the end of the world but rather an opportunity to achieve success over this unprecedented event.

Stay safe and healthy. To the recovery!

LODGING On Demand — Episode 7: How Hoteliers Can Cut Costs During COVID-19

This episode of LODGING On Demand examines what hoteliers can do to cut costs during the COVID-19 crisis. LODGING Editor Kate Hughes speaks with Wayne West III, president of Newport Hospitality Group and chair of the IHG Owners Association; Brad Rahinsky, president and CEO of Hotel Equities; and Bob Rauch, chairman and CEO of RAR Hospitality, about steps hoteliers can take to save money during the coronavirus pandemic.

Bob Rauch featured in Lodging Leaders podcast episode

🎙🎧 Bob Rauch was featured in a Lodging Leaders podcast episode. His interview is in the last 10 minutes. Tune in here.