That Nasty “R” Word

As 2019 comes to a close and a decade of economic growth and prosperity in the U.S. Hotel Industry is documented in the history books, the industry is looking for clues that foreshadow the beginning of a new decade. Without a crystal ball to rely on, experts look to trends and economic indicators for signs.

Portent of doom

At the 2019 Hotel Data Conference in August, there was lively speculation about an economic slowdown – a downturn. Dare we even foretell a full-on recession in 2020?

The economic expansion the United States has enjoyed was already long in the tooth.

The bull market on Wall Street was in its record-setting 10th year.

There were signs of downward pressure from the global markets as trade wars, tariffs, and uncertainty about Brexit ruled the news cycle.

Then since HDC, the U.S. Hotel industry recorded two consecutive months of year-over-year RevPAR declines in September and October, and three months total in 2019 when we include June.

The speculation was certainly justified. However…

What a difference a month makes.

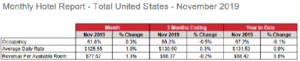

On December 18, 2019, STR released US Hotel performance for November, which showed positive year-over-year change. Although one month may not qualify as a trend, the news is positive. In November of this year, Occupancy, ADR, and RevPAR all increased compared to the year before. This was the first time since July. The first two weeks of December show continued growth in RevPAR over last year as well.

For the three-month period ending in November, however, the KPIs are still in the red, coming off the aforementioned declines of September and October.

Source: STRIs this a year-end storm brewing or a silver lining?

The announcement from STR came off the heels of other good economic news, including better than expected U.S. manufacturing output in November, as reported by CNBC. This was a reversal of three consecutive months of manufacturing contraction. Further making the case, short-term interest rates were kept steady by The Federal Reserve, a signaling of confidence by The Fed board that further economic stimulus isn’t necessary. Even more important, the economy is not “overheating” as was the concern in 2018 when The Fed increased rates four times to hedge inflation.

Unemployment remains at historic lows, a trade deal with China is imminent, and Congress passed the United States-Mexico-Canada Agreement (USMCA) trade agreement this week. This trade agreement has the potential to increase tourism to the United States, which is already the nation’s #2 “export”. Travel economists predict the USMCA will raise $1.7 billion in travel-generated economic output and create 15,000 jobs. That’s on top of the already $2.5 trillion and 15.7 million jobs supported by the US travel industry.

Finally, the consensus of Wall Street analysts is to expect that in 2020, corporate earnings will rise just over 10%. While this is a rosy picture indeed, even at half the consensus estimate, that is enough to keep the economy and financial markets moving in the right direction.

I make no claims to be an expert in economics, but I admit that I’m excited as 2020 approaches. While headlines focus on news of President Trump’s impeachment, the economy keeps chugging along, and the hotel industry is not yet ready to throw in the towel. Will growth of the U.S. Hotel industry be challenging in 2020? Most certainly, as supply and demand have reached equilibrium, and real ADR growth is not keeping pace with inflation. RevPAR growth will be stymied in some markets, and a slowdown in growth is very real. But does that spell Recession? It does not.

By David Beaulieu

Director of Client Services, Total Customized Revenue Management, LLC

Original Article:

https://www.tcrmservices.com/is-a-recession-coming/

December 20, 2019