Hotel Industry 2020 – The New Normal

Welcome to the Twilight Zone or the surreal existence of those of us in hospitality with empty hotels. They are slowly and not so surely picking up but we will return to a “new normal” soon. What will it look like? The “light and warmth of hospitality,” coined by Conrad Hilton, will not be apparent upon entrance to a hotel post COVID-19. Expect acrylic covered front desks, masks and gloves, signage advising guests to use caution, frequent disinfecting of public spaces, wide open lobbies with limited seating and restaurants and bars that have six feet of separation in every direction. The good news is that we are approaching the re-opening of the economy!

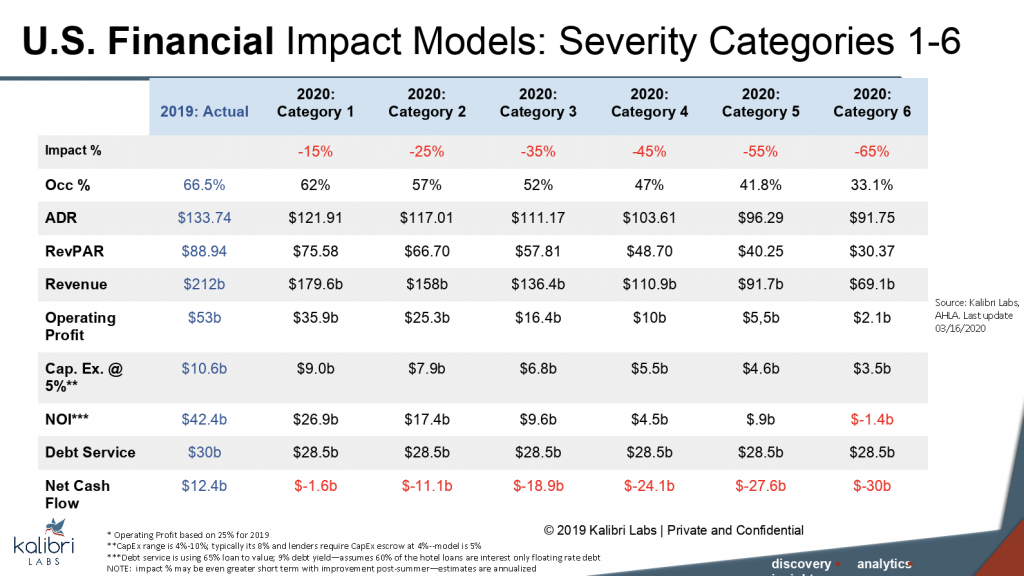

According to the top prognosticators in the hotel industry, here is what we are looking at from an occupancy, average rate (ADR), RevPAR perspective:

| CBRE | HVS | STR | Kalibri Labs* | Average | |

| Occupancy | 42.6% | 43.1% | 37.9% | 49.5% | 43.28% |

| ADR | $109.98 | $111.61 | $112.91 | $107.39 | $110.47 |

| RevPAR | $46.85 | $48.15 | $42.84 | $55.25 | $48.27 |

| Release Date | April 23 | April 27 | March 30 | April 29 | n/a |

*based on six Impact Models: Severity Categories 1-6, average of Category 3 & 4 – the entire model is included at the end of this article

The best case seems to point to a drop in occupancy from 66% in 2019 to 50% in 2020 and a drop in ADR from $133 to $107 resulting in a RevPAR drop of over 30% from $88 to $55. Worst case scenarios have us dropping well below 50% in RevPAR, close to Armageddon. Once STR releases an April forecast, the overall average should increase. These firms have done a tremendous job of analysis given the completely different demand generators—the bad news here is that even in the best scenarios, there are no net profits forecast for 2020.

Operations

From an operations perspective, labor costs may contract as operators flatten organizations to eliminate middle management and reduce paperwork, freeing up senior management to interact with guests like hospitality should be. Operating costs may increase as we sanitize and disinfect religiously. Profits will be gone in 2020 with hopes of a return to closer to normal revenues and profits in 2021 or 2022. The implementation of completely new protocols including hospital grade sanitization, masks and thermometers will be fairly expensive relative to supply costs.

Valuation

We can expect values to decline in line with net income, but with less deals done. The real question will be when will values come back to 2019 levels and will it be a buyer’s or seller’s market. The latter depends on how long it will take for this destabilized market to bounce back. Over-leveraged sellers will be at risk as short-term values will take a precipitous drop. However, lenders will only foreclose on operators who do not engage in a sincere way. They do not want to own hotels. Transaction volumes will be down according to an April, 2020 Lodging Industry Investment Council survey.

Supply

Airbnb and short-term rentals will continue to impact hotels. With unemployment numbers at new highs, millions of Americans will need to find a way to supplement their income and home sharing may be people’s means to do so. New supply for those accommodations could surge and have a negative impact on hotel room rates in general. But many cities have sued Airbnb and our original prediction was that they would become an online travel agency (OTA) by 2020. Well, only time will tell, but they have postponed their 2020 IPO.

Demand

We will start to see two separate groups emerge – those who feel they can travel freely, and those who are still susceptible to the virus. The first group is made up of individuals who have tested positive for the virus anti-bodies – meaning they had the virus and lived and those who believe they are not at significant risk. This group will be our primary source of demand, while others may continue to quarantine and limit travel. This summer, we can expect to see “pent up” demand. After being stuck at home for eight or more weeks, consumers will be itching to travel.

What’s Next

Clearly, there will be hotel types and markets that will outperform others. Resorts and downtown hotels will have a longer road back and markets that do not have a drive market within 150 miles of them will also have to wait for air travel to return to near normal. Larger hotel brands may seem more trustworthy in terms of their cleaning protocols over smaller boutique hotels, but the American Hotel & Lodging Association has a “Safe Stay” program for all members that might level the playing field. Beach and other outdoor-centric destinations will also reap the benefits of the unquarantined masses. Corporate business is not ready to return and group business is at least 5 months away from a return to near normal.

So, we are in a new normal that will change every month as states adjust and tweak their distancing rules and guidelines for business openings. Those states that understand the balance needed to open safely while protecting the at-risk population will recover much faster than those that are afraid to open anything at all. We can’t be afraid forever – after all, we are not even sure that Sweden was not more effective at handling this than we were. To a safe, smooth opening of the economy into a new normal summer where we can all take a sigh of relief!

By Robert Rauch and Sarah Andersen