Top Ten Trends in Hospitality 2021

Today’s hotel business models look entirely different from their predecessors. COVID-19 is just one earthquake that has jolted the landscape this year. The hotel industry must evolve and reinvent itself to exploit the opportunities and cope with the challenges it faces. After all, this industry is no stranger to disruptions. As we do every year on December 1, the top trends shaping our industry next year will be:

- Sanitation and Cleanliness Standards

Hotel employees and guests must participate in a complete upgrade of sanitization and cleanliness. Each brand has added a different touch, but there are now two levels of room cleaning – the second level being a supervisor who provides the extra sanitization of each room. These protocols are here to stay and guests are willing to play their part by washing hands frequently, wearing a mask and distancing.

2. Use of Outdoor Spaces

Meetings, dining and recreational activities have all shifted outdoors. Even as the weather turns, it seems guests prefer to spend time outdoors where the virus is less likely to be contracted. Further, the simple pleasures of hiking and biking, visiting state parks and traveling closer to home are able to satisfy the pent-up demand to get away.

3. Locally Produced Products

Products that are considered organic and/or farm to table are trendy amongst all demographics. This surge in popularity parallels the country’s growing focus on environmentalism. In addition to being more environmentally conscious, people everywhere are also looking for more locally authentic experiences, starting with what they eat. These efforts drive customer loyalty and create community partnerships like local wine/food events – socially distanced, naturally.

4. Meetings, Restaurants and Hotel Technology

Contactless food and beverage is paramount to restaurant success today. No menus, no checks that require contact, just a simple QR code and a knowledgeable server to review specials and answer questions are all that is needed. All meetings must also be designed to be properly distanced either with diagramming software or by carefully measuring out tables and chairs. Automated check-in via smart phone is preferred by guests – no contact with employees.

5. Value Consumers are here to stay

We have seen the re-birth of the value traveler in this new normal. Value travelers want booking platforms that provide transparency about cancellation and refund policies, trip insurance options and lift and rebook options in the event the destination has new travel restrictions. They love safe activities added at little or no charge and shop both price and overall value. They are looking for quality as well as a low price.

6. Sustainability

Guests want to travel more sustainably and we expect to see more guests with that mindset begin to hit a critical mass in 2021 and beyond. Awareness about the impact on the environment and local communities has increased as more people are traveling closer to home. A Booking.com survey of international travelers indicated that more than two-thirds (69%) expect the travel industry to offer more sustainable travel options.

7. Travel Trends in General

According to MMGY’s travel intentions surveys, many travel categories have declined since last month with the spiking virus numbers. Traveling by personal car is still considered the safest method of transportation and the perception of safety around lodging has leveled off in the survey results. Americans are remaining steady in their trust for dining and entertainment. Interest in business travel remains steady as well but we have not seen strong signs of an increase in business travel yet.

8. A New Flat Organization

Keeping a finger on the pulse of utility, maintenance and property costs as well as labor costs by department has been critical for hoteliers this year and this will continue to be the case in 2021. Driven by unprecedented RevPAR declines in 2020, hoteliers have condensed their corporate and operations teams and more employees will report directly to managers, not supervisors.

9. A New Focus on Cash

The COVID-19 pandemic has and will continue to have economic and financial ramifications that will be felt by the hospitality industry for years. With a full recovery lagging because of lasting difficulties with the virus and the recent elections, managing cash flow will be more important than ever in 2021. It can’t be assumed that financing options or stimulus money previously available will continue.

10. A New Type of Hospitality

Savvy hoteliers need to find creative ways to repurpose these now underused spaces. Hoteliers are looking to get extra revenue from guests who want month-to-month apartment-like units. Since hotels are set up with high-speed internet and a work-friendly desk, they have also made a fairly easy transition to co-working spaces and business offices. Many guests are remote workers who are looking for a tech-package that suits their remote working needs–this includes wi-fi that extends to outdoor spaces!

Wishing you a safe and healthy holiday season!

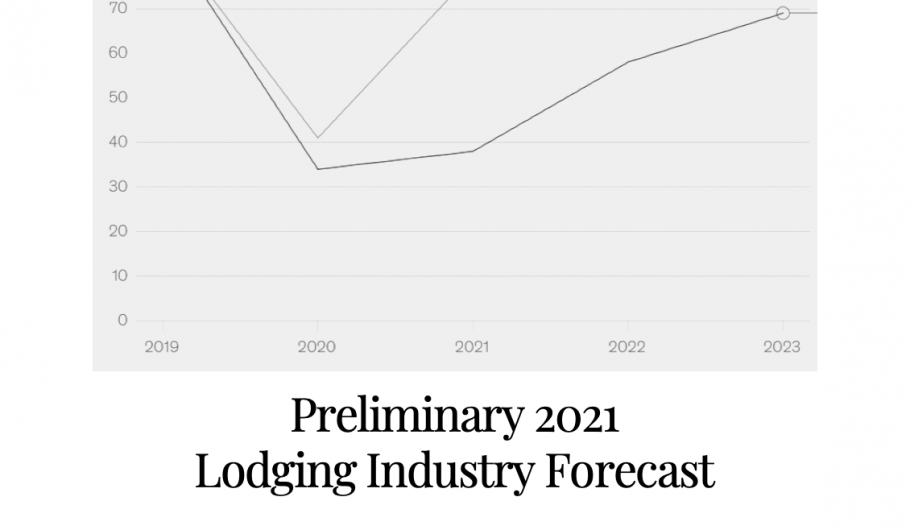

Preliminary 2021 Lodging Industry Forecast

We have made some assumptions for 2021 – first, Q4 2020 and Q1 2021 will remain flat as corporate business begins to build just as leisure business begins to decline. Second, a stimulus package is imminent right after the election, regardless who wins. The politics of this election, coupled with the divisiveness of the nation, has disrupted everything except for the stock market. Third, gross domestic product will increase about 3% after being down close to 5% in 2020.

Our favorite economist, Bernard Baumohl sees a Biden victory as better for the economy with a 3.4% GDP growth and a Trump victory as bringing in GDP growth of 2.2% in 2021. His primary concerns are trade tension and the economic divide with a President Trump.

Changes that we see coming in 2021 and beyond are more remote work, US improvement in manufacturing at the expense of China and retail malls losing ground to delivery. Indicators like consumer confidence, employment, business growth and capital markets have been impacted significantly by the virus– without a stimulus package, the travel industry will be on the brink of collapse.

McKinsey, in their September survey, indicated that travelers are willing to travel, even without a vaccine. This is noticeable in September and October revenue numbers, showing summer vacations continue into fall. China is seeing both the leisure and business travel segments recover as it has effectively controlled the spread of the virus. In the US, we are seeing a considerable increase in searches and advance bookings but they are largely leisure travel as corporations have restricted business travel.

According to MMGY’s Traveler Sentiment, psychologically Americans are becoming increasingly comfortable with pursuing travel-related activities. Even theme parks, meetings, conventions and cruising are seeing positive signs. We have learned how to incorporate safety measures such as wearing masks, social distancing and washing our hands into our day-to-day lives, and that is fast becoming a natural part of travel as well. As confidence rises, and with the holidays just around the corner, the desire for attractive travel deals is also on the upswing.

So, what happens in 2021? January to March remains largely the same as there is still no sign of group business. Corporate business continues to improve, albeit slowly, holding occupancy up to where it has been for the past 120 days. By April, all three segments of corporate, group and leisure will improve, with or without a vaccine. Q2 is the beginning of a massive recovery that puts occupancy levels up over 50% nationally by the end of the year. Average rates begin to climb in summer of 2021, with rates within 15% – 20% of 2019 in some markets. Q4 ushers in a return of convention business. By the end of the year, everyone will be happy again as cash flow will return in 2022.

The bottom line is that we are a little bit beyond the halfway point of this virus disaster. March 2020 – March 2021 will go down in lodging history as the worst 13 months ever recorded. The recession will end but it will take until 2022 before we are 90% recovered and 2023 until we are back to 2019 numbers. For some hotels with heavy reliance on groups, recovery could be closer to 2025. By then, costs will have increased and hotel values will just begin to return to normal.

Hang in there—we have endured over 7 months of this mess. If you want to be more conservative, mark June 2021 as the end of the recession.

We are still almost halfway there! I’m ready to celebrate – are you?

Hostmark acquires RAR Hospitality

Hostmark Hospitality Group continues to grow with the acquisition of RAR Hospitality, a San Diego-based hospitality management group. The combined company now will own and operate both limited-service and full-service as well as branded and independent hotels across the United States with a portfolio of 40 hotels totaling over 5,000 rooms, as well as restaurants. Operations of RAR’s portfolio will continue under the Hostmark brand in its San Diego office.

“RAR Hospitality has exhibited the breadth and depth of experience that is required in successfully managing boutique and independent hotels. The company’s entrepreneurial spirit and proven track record drive their mission of experience-focused hospitality,” said Hostmark President/CEO Jerome Cataldo. “During a time of uncertainty for the entire hospitality industry, Hostmark plans to continue serving its clients to the highest level, focus on creative ways to grow revenue and growing its portfolio of managed properties.”

RAR is an independent hotel management company owned and helmed by Chairman/CEO Robert A. Rauch and President Cameron Lamming. The company’s executive team has an average of 25 years of hospitality experience and has been involved in more than $2 billion of real estate transactions in California, Arizona and Colorado.

“The combined leadership team of the expanded Hostmark brand will work together to build a new, forward-thinking and disruptive hospitality management firm that will continue to grow through the current industry landscape,” said Lamming, who will assume the role of chief development officer, Western region for Hostmark and will be a member of Hostmark’s executive committee. “We have carefully strengthened our position and updated policies and strategies to continue the high growth rate each of our companies have achieved over the past few years without compromising any part of our hyper-high service model.”

Hostmark Hospitality Group expects its expansion to continue rapidly throughout 2020 and beyond, according to the company.

“We are excited for what the future holds and plan to do great things with the RAR team, as we continue to aggressively grow our hospitality management platform, including additional M&A deals,” said Hostmark partner Thomas Prins.

Setting up 2021 for success

To survive and thrive, hoteliers must reinvent hotel sales, marketing and operations. Here’s how to do that.

We have probably reached the midpoint of the Coronavirus Recession.

We say that because we hit bottom quickly in April and came back up a bit this past summer. Many industries were not hit, but the virus-caused recession has taken its toll on this economy. If you believe that Q2 was the bottom and Q3 was slowly trending up, but that Q4 and Q1 of 2021 will continue to have headwinds that prevent economic success, you are with us.

Adam Sacks, president of Tourism Economics, predicts that it will take roughly three yearsfor hotel demand to bounce back to 2019 levels, while CBRE foresees demand for U.S. lodging accommodations returning to pre-crisis levels in the third quarter of 2022. Because much of this decline is not caused by underlying fundamental economic problems, most market segments should start to see meaningful relief in Q1 and Q2 of 2021. However, COVID-19 will continue to define this fragile economic recuperation.

Most experts think a vaccine is likely to become available by mid-2021, but nothing is guaranteed, and vaccine distribution poses another significant hurdle. So, when will this multiyear recovery begin and what segments can we expect to bounce back sooner? To survive and ultimately thrive, we must reinvent marketing, sales, operations and accounting. Here is a game plan that might work for you if you feel like you do not yet have a plan to break even over the next 15 months.

Marketing

Use aggressive, consistent digital marketing, such as wine or beer tastings, food or even chocolate events, geared to specific groups like brand loyalty members or local guests of your currently closed restaurant. Constantly stay in touch and be positive about what you and your team are doing in the community. Maybe you donated a roomnight or did something nice for a local charity. It is critical to stay in front of your guests, potential guests and those who can influence business for you.

Facebook can laser-target guests to your page, Instagram allows you to do more fun things and digital marketing allows you to personalize your approach to guests. Every property has something to offer, even if you must manufacture the asset. As an example, you have no spa, but outdoor massages are legal in your county—hire a massage therapist to do free five-minute massages and have them schedule a massage. Serve herbal teas in a socially distant environment. This is not the end of the world, merely the end of what “used to be.”

Sales

Reactivate all dormant accounts and leads. We’d be willing to guess that your hotel has hundreds of dormant accounts and leads that are either in the computer or a sales department file. Call every single lead and offer them a socially distant idea—meeting in your boardroom for a handful of team members, include snacks, beverages, food and let them know you just want to be there for them if they need anything.

To marry sales with marketing, package everything you can think of to stimulate that company or family that needs an all-in type of price. Room, parking, food and anything else you can offer including late check-out. Package at a family-friendly price and sell via Facebook or digital marketing. If you normally do not love a certain customer profile, i.e. soccer teams, think about expanding just beyond your comfort zone. You’ll be OK!

Operations and the bottom line

Your team knows what they can handle. Offer those who are go-getters to expand what they do in their off-peak time. As an example, we replaced a controller with a combination of a third-party accounting firm and a desk clerk who had some accounting experience. Voila! Money saved. To increase revenues in our food and beverage department, we created an aggressive “food and cocktail to-go” program. A little bit of packaging, some digital marketing, a poster here and there and the program dramatically increased F&B sales.

The bottom line is that even with a slight improvement in average daily rate and the eventual rise in occupancy through 2021, pricing confidence will waver as global uncertainty around the pandemic persists. We can be certain that recovery is inevitable. Demand drivers will eventually be realized and the need to travel and create new experiences will still be present at the end of this crisis. Until then, resilient owners and operators must continue to hang on and weather the storm. Remember that cash is king, so frequent cash flow updates are paramount to success!

By Robert Rauch Sarah Andersen

Read original article on Hotel News Now here.

Is some Americans’ aversion to wearing a mask holding back the economy?

Bob Rauch, R.A. Rauch & Associates

YES: If we slow the spread of the virus, the economy will open up. Even if it is not the mask itself that slows the spread, the symbol of being cautious and following government guidance will allow for the government to open up the economy. Coupled with a stimulus package, the opening up of the economy will restore jobs and boost small businesses up enough to survive.

Read full article by Philip Molnar here.

LIIC members share lessons hoteliers should learn from the pandemic – Part 1

Mike Cahill of HREC, Sean Hennessey of Lodging Advisors, Andrea Foster of Marcus Hotels & Resorts and Bob Rauch of RAR Hospitality speak about the lessons hoteliers should take away from the coronavirus pandemic.

Watch the video here

2021 Hotel Forecast

The COVID-19 pandemic has caused unprecedented disruption to the hospitality industry, so when it comes to mapping a post-pandemic recovery, it’s clear that we are in uncharted territory. The Lodging Conference hosted Bernard Bauhmohl, Chief Economist of the Economic Outlook Group. His remarks related to vaccines, treatments, lack of stimulus package and election results led us to believe we are in for a longer ride along the trough of this recession.

Our assessment is that we are at the midpoint with Q2 and Q3 behind us, two more quarters of recession will put us at one full year, close to the average length of a recession in the U.S.

The good news? Baumohl believes that either presidential candidate will deliver a positive GDP growth in 2021 between of 2.2% if Trump wins and 3.4 percent if Biden wins. He indicated there would be several lasting changes post-COVID-19. These include the economic divide continues, the US takes back the lead in manufacturing from China, remote work continues, corporate travel is reduced by 10-15% and there is movement from urban markets. He added that public health is now a national security issue, retail malls are out, there is a rise in xenophobia and the Federal Reserve is now politicized.

Adam Sacks, president of Tourism Economics, predicts that it will take roughly three years for hotel demand to bounce back to 2019 levels, while CBRE foresees demand for U.S. lodging accommodations returning to pre-crisis levels in the third quarter of 2022. Because much of this decline is not caused by underlying fundamental economic problems, most market segments should start to see meaningful relief in the first and second quarter of 2021. However, COVID-19 will continue to define this fragile economic recuperation. Most experts think a vaccine is likely to become available by mid-2021, but nothing is guaranteed and vaccine distribution poses another significant hurdle. So, when will this multi-year recovery begin and what segments can we expect to bounce-back sooner?

Corporate and group travel remain elusive and will lag behind leisure. Hotels reliant on large group and conventions will be slow to pick up as meeting attendees get reacclimated to being close to large numbers of people. Destinations with appealing natural amenities such as beaches and mountains have already seen a high influx from pent-up demand this summer and will likely hold steady through the fall. Drive-to locations are also experiencing increased occupancy levels.

Even with a slight improvement in ADR and the eventual rise in occupancy through 2021, pricing confidence will waver as global uncertainty around the pandemic persists. We can be certain that recovery is inevitable. Tipping points in the coming months will include cleanliness, customer trust, and disruption from short term rentals, OTAs and other hotels. Bandwidth, AI, mobile, and touchless technology will continue to drive engagement and delight guests. F&B needs to be personalized and creative with “Instaworthy” moments, while maintaining safe social distance practices in accordance to local ordinances. Expect social media marketing and user generated reviews to dominate public relations and reputation management. Staying on top of new technology will wow guests and should be a necessity at this point.

Customers are interested in traveling again when restrictions lift, even willing to do so before a vaccine is available at scale. According to the McKinsey & Co. September report, “we see a considerable increase in searches and advance bookings —however, due to necessary public-health measures and safety precautions—such as quarantines, closures, and other restrictions—the leisure space may be curbed by the inability to do anything meaningful at a destination. Similarly, many business travelers who are ready to fly again may be limited by corporate travel policies and companies’ understandable focus on duty-of-care obligations to employees.”

For the San Diego lodging market, we believe supply will increase by 2 percent, while demand will continue its downward trend by -17 percent in 2021. Occupancy in this market will see a 15 percent increase, rising to 65 percent with an ADR of $145, resulting in a $94.25 RevPAR. Other Top 25 markets will be slower to recover because of their tendency to be situated in urban and resort-type locations with heavy reliance on international and corporate travel. And remember that supply numbers are coming up due to the closure of many hotels between April and October of this year. This will keep pressure on average rates and occupancy levels as more rooms are available for far less travelers now that summer is gone.

The pandemic and the rise of remote work have accelerated growth of the “bleisure” travel segment. Demand drivers will eventually be realized and the need to travel and create new experiences will still be present at the end of this crisis. Until then, resilient owners and operators must continue to create and adapt action plans for the new year. Watch consumer spending trends, employment and business growth as we approach year end. Keep your eyes on capital markets and interest rates and stay nimble! To a stronger 4th quarter than most people expect!

HNN: Hotel robotics thriving in 2020

Technology is transforming the hotel industry by leveraging the power of robotics and artificial intelligence.

When looking at productivity, hotels are using robotics not to supplant jobs, but rather to make them more effective and efficient. These technologies are designed to support the natural evolution of the hospitality sector and are functional in each department, from housekeeping to revenue management. Guests want personalization and information at the touch of a button and it is our job as hoteliers to meet this growing demand. At first sight, robots may look like a gimmick, but there are some hard economics behind it as the hospitality industry looks to return to profitability.

Housekeeping

Hotels are implementing high-tech solutions to keep guestrooms squeaky clean. From automated vacuums to virus-killing robots, these cutting-edge technologies are bridging the efficiency gap between humans and robots. For example, robot vacuum cleaners are leaving mundane and dangerous tasks to autonomous solutions, allowing the housekeeping department to focus on lower-impact work that may not have as much potential to cause back injuries.

In addition to helping reduce housekeeping-related injuries, these bots help hold labor costs in check by decreasing the time it takes to clean each room. At another property, an electrostatic disinfectant sprayer is being used to kill bacteria and viruses through fast coverage of complex and hard-to-reach surfaces that could be easily missed.

Front desk

The next time you order room service, it may come by robot. Robots are now making contactless deliveries directly to guestrooms. At one of our properties, “Hubert” the room-service butler provides a better guest experience by taking on tedious tasks like in-room deliveries, which frees our staff to focus on the more complex needs of the guest. Guests’ reaction to this robot has been really positive. People appreciate the convenience and enjoy the novelty of seeing a robot deliver their snacks and amenities. An added plus: Snack sales have seen a strong surge.

Food and beverage

The use of mobile ordering technology can also help in converting traditional dine-in food-and-beverage outlets to takeout and delivery outlets. This allows hotels to comply with social-distancing ordinances and keep guests safe. Guests (millennials in particular) want to view, order and pay for hotel guest services from their own device. To meet this growing demand, hotels are using cloud-based mobile ordering solutions designed specifically for hotel guest services. Our NY Garden Deli and Bistro 39 restaurants, for example, use contactless dining solutions that allow our guests to view the menu, pay at the table and much more, all contact-free.

Restaurants for many years have been trying to identify ways to be more self-service-oriented. The combination of food costs, labor costs and overhead have made profit margins razor thin. 2020, thanks to the virus, has exacerbated this challenge. Now restaurants can use QR codes as a menu, thus avoiding the printing of menus. At the same time, guests can use their own devices for the entire experience.

Final thoughts

Automated systems are beginning to deliver unprecedented value to hotel operators and guests. Robots and AI are holding costs in check while improving quality and consistency. Operators will see an increase in profitability, healthier staff and higher guest satisfaction. We have been predicting that AI and robotics are coming. Now they are here.

By Robert Rauch Sarah Andersen

Read original article on HNN here.

Econometer: Is buying two hotels in San Diego County for homeless people a good use of funds?

Q: Is buying two hotels in San Diego County for homeless people a good use of funds?

Read full article by Phillip Molnar here.

What a difference a year makes | Post COVID hotel planning

Consider this advice on how to prepare and develop a business plan for the COVID-19 recovery year.

When I wrote an article on business plan development for 2020 suggesting flat occupancy and rate, I stated, “Naturally, the caveat is that unexpected ‘event’ that could stimulate a precipitous decline in demand.” If I had known about the pandemic one year ago, I could have saved lives, but I did not. I just knew that we have to be prepared. I think we have done an excellent job responding to business conditions on the ground, but what do we do for 2021?

The first thing needed is a review of macroeconomic data, which currently indicates a combination of a major global slowdown and recession. Unemployment is now quite high, consumer confidence is weak and the short-term economic conditions are awful. STR, parent company of Hotel News Now, is forecasting a decline in revenue per available room of about 30% in 2021 and most pundits are in that range, some worse.

Business travel is starting to come back, but slowly. Airlines are reporting low load factors and there are few segments in hospitality that are doing well. Quarantine restrictions are killing business travel, and when it begins to return after Labor Day, it will take at least the better part of 2021 before it approaches 2019 levels. Advances in therapeutics will help as well as a vaccine.

Leisure travel demand bottomed out in April as we approached 20% occupancy levels with the help of first responders, doctors, nurses, hospital staff and the few government-related projects that remained. Add in a few home-replacement guests and voila, 20% occupancy at low rates!

As COVID-19 cases continue to spike across some areas in the country, consumer confidence appears to have declined, especially when it comes to travel. MMGY reports that likelihood to travel for business has dropped 7 points over the last month, but leisure travel intent has remained steady at 40%. This indicates a resilient traveler segment that will be open to messaging and marketing.

With hotels reopening and cash burn rate way ahead of where we’d like to see it, we must prepare for deeper cuts in cost to survive a difficult recovery. Some of the groundwork has been accomplished with examples like grab-and-go food, more technology, eliminating stayover housekeeping service and bottled water in rooms as well as outsourcing everything from marketing to sales to human resources and accounting. We have already eliminated the controller position and put more responsibility on the GM to be aware of all things financial with the help of a third-party accounting firm. Additionally, we have outsourced our digital marketing.

Targeted digital messages and social media marketing can reach the drive-to market. At one of our properties we started packaging breakfast and dinner to both increase the value proposition and to get some food-and-beverage revenue to offset costs.

In Miami, apartment complexes are providing live concerts for residents. Granted, the building needs to be set up overlooking the pool or a central hotel area, but it can also be effective as guests have not heard live music for a while!

According to Cleveland Research, occupancy to date appears supplemented by contract business on the books including healthcare/first responder, government and displaced persons and some logistics/construction business. Their research continues to highlight outperformance in secondary/drive-to markets and extended stay while lower chain scale/select-service type properties continue to support the current month-to-month improvement in the trajectory of RevPAR.

At the end of the day, while much more difficult to forecast, the business planning must begin. It is a request for proposal season (RFP) and we must target our markets, determine where we can cut costs and figure out how to stay in business another year before things settle down and return to normal, whatever that ends up being. To 2021!

Check out the original article on Hotel News Now here.