10 Travel Trends That Will Happen in 2022

These trends were first published by Hotel News Now in November 2021.

Travel is taking a new direction in 2022 and it’s important for hoteliers to continue adapting to the consumer changes for these travel predictions. Through a combination of technology, guest expectations, and employment, here are the most important traits to consider in your 2022 management plan. Enjoy reading these trends and have a spectacular and very Happy New Year!

1..The talent void – We furloughed and laid off the majority of our workforce, but we can fix it by recruiting those with strong communication, technology, sales and analytic skills. Yes, we will pay them more but they will perform better and will provide superior customer service that is currently lacking.

2. Live events 2.0 – We will see the return of live events but for a while, they will often include a hybrid component. Companies know they must send their key sales people on the road, but rather than send 4, maybe 2 stay back and pay a reduced admission fee and have access to all the speakers and presentations. The live events will often have strict protocols, on-site COVID testing and more. Every hotel chain is jumping in with their own version of hybrid meetings technology.

3. Contactless transactions – These are here to stay. Nobody wants to touch something that is not clean and sanitized, whether it be in a hotel, restaurant, attraction or meeting environment. Mobile ordering, digital check-in, QR codes, self-service kiosks, digital menu boards and much more. Why? Because they are both safe and effective at reducing labor costs.

4. Hygiene, sustainability, safety and wellness – Firms like Ecolab have been working on the hygiene part of this equation for years. Add in the consumer preference of sustainability and the pandemic’s impact on thoughts about wellness and these all meet up for a package of plastic reduction, reusable spray bottles, recycling, water savings and more.

Sanitizing stations will live on and third-party health and wellness ratings will become commonplace.

5. Death of the good-old boy network – Guests appreciate great service but knowledge of what guests wanted in the 1900s does not make for a successful hotel. Guests want technology that provides them with 2020s quality of life. Fast, free Internet, texts that keep guests updated, smart TVs with the content they want, contactless transactions, use of the mobile phone for everything and more. Add in positive reviews and they are happy!

6. Sales are forever changed – Sure, the basics are critical and sales calls have not changed dramatically, but prospecting tools have changed, booking technology has changed and the process is no longer manual. Order takers are out, data and technology are in and the hybrid meeting component alone will eliminate those who just don’t get it

7. Technology is an investment, not an expense – AI-enhanced guest communications, customer service robots and automation in the front and back of the house will improve profits both short and long term. As an industry, we need to embrace automation, not because it will reduce labor but because it will drive revenue and automate manual, repetitive tasks. Given our labor shortages and increased cost of labor, we get a bonus.

8. Art to science – Yes, our industry is still an art. But it has morphed into a science, first with revenue management and now with all things digital, the Internet of Things (IoT) and digital disruption to name a few. Airbnb and other short-term rentals are nibbling away at our market.

9. All things digital – Every channel that we go to for rooms costs dollars and we need to know how much! How do we develop a business plan post-pandemic? We need every tool in the toolbox and they are all technology-oriented.

Web sites, digital marketing, laser-targeted sales, and knowledge of the changing landscapes are required. Get help from Kalibri Labs, they have the toolbox (no, I do not have a special relationship with Kalibri).

10. Wow customer service returns – Personalization and a return to wow service that we have not seen in a long time will return this year and be a differentiator. All the technology in the world won’t bring people back without this. Hire today’s women as they really get this!

With these shifts in consumer travel trends for 2022, we expect an ongoing recovery to our room revenue and occupancy rates – we should hit very close to 2019 numbers for most US properties. The exceptions to this are convention hotels and those that have large amounts of group and corporate business. Those hotels will see a strong pick up in Q2 of 2022.

In our October 2021 Economic Forecast for 2022, 50% of our readers predicted 2022 as the recovery year, while 40% suggested 2023 was more reasonable. Continue to hang in there and utilize these predictions and tips to speed up your economic recovery. See you in 2022!

by Robert A. Rauch

rauch@hotelguru.com

2022 Hospitality Industry Forecast

Note: last month, we started using a debate platform to ask readers about their thoughts on a subject, so we ask this question above that can be answered from the sided.co debate platform.

2022 – A Magical Year or More Misery?

That’s easy – our hospitality forecast says the bumpy ride is coming to an end. We should assume 6 more months; October through March might remain uneven or bumpy. Why? Because business travel is not back and group business is just starting to book going forward. International travel will likely return in April, 2022 when we should be back to 2019 numbers. The 2022 hospitality forecast says you should hang in there!

At the Lodging Conference, Bernie Baumohl, Chief Global Economist of the Economic Outlook Group, my favorite and Wall Street Journal’s #1 most accurate economist was a main draw for me at this great conference. While he placed a caveat that his forecast is based on no debt default by the US (the debt ceiling is October 18, 2021) and no $3.5T bombshell White House giveaway, his information was timely and interesting. He did bake in the $1T infrastructure package currently being finalized (hopefully) in Congress. Based on the economic outlook and hospitality reality, here are our thoughts.

Business Plans and Budgets

Most hospitality operators are smack in the middle of budget season. Business plans should be done, budgets should be in process and according to Bernie Baumohl, the consumer price index is up between 4-5% and will slow to 2-3% by mid-2022. He talked about the mismatch of skills that technology providers are facing and made some predictions (those mismatches could bode well for hospitality as we have struggled to hire and do not need all employees to be tech-savvy).

Bernie Baumohl Predictions:

- GDP will finish at 5.7%, drop to 3.1% in 2022 and drop further to 2.4% in 2023

- Unemployment and Inflation will hover around 5% this year and drop to 3% in 2022

- Delta variant still is a concern

- There is a supply chain bottleneck that persists

- Energy prices and cost of goods are cutting into consumer spending

- Vaccination rates are rising and people are going back to work

Inflation and Deflation in the Hospitality Forecast

While inflation has put a dent in consumer confidence lately, Bernie forecasts an impending inflection point that could send some advantage back to consumers. Our concern is that it could lead to deflation but we can hope that he is right and inflation pressures will come down to 2-3% by 2023.

Business, International Travel and Recession

Bernie Baumohl’s forecast for business travel is that 90% will come back in the next year or so, vaccine boosters and vaccination plans for children will stimulate more travel and international inbound travel to the U.S. will pick up. With the caveat of no more major virus shocks, the passing of the U.S. infrastructure spending package, and a raised or suspended debt ceiling, Bernie said, “recession is off the table for the next five years in the U.S.”

STR Reports

STR reported that profit margins improved in July due to the combination of demand and leaner hotel operations. Their overall status report on the industry is:

- Demand is driven by the transient consumer

- ADR is driving RevPAR growth

- Business travel and groups are needed now more than ever

- 2022 forecast shows improvement but not yet back to 2019

CBRE Reports

GDP continues to set new records and they forecast most markets will return to full employment by mid-2022. Their takeaways were:

- The recent spike in COVID cases has not led to steep declines in mass transit use

- Recent travel trend data all indicate demand and travel trends ~20 – 25% below 2019

- International travel restrictions will ease in November

- Increases in construction costs, weaker demand trends, and labor challenges will result in slowing supply growth.

- Short-term rental market share has normalized, and the bulk of the spike seen earlier in the year was driven by hotel closures.

- GMs, yield management systems, and revenue managers have learned to push rates and cut costs, driving efficiencies during the recovery.

Final Thoughts

While plenty of waves could rock the ship including supply chain disruptions, Bernie seemed pretty bullish on 2022, especially beginning in Q2. May we all hang on until then and have a great recovery year ahead!

The Road Ahead for Hotels in 2022 and Beyond

Before we jump into 2022 plans, please take the quick survey/debate above of how you view the business and feel free to opine on why. Answers will appear on sided.co and on the hotelguru.com website.

Hotel Industry Post-Pandemic

The number of areas of responsibility that fall under a hotelier is hard for other businesses to imagine. Development, acquisition, finance, operations, customer service, restaurant, bar, maintenance, sales, marketing, revenue management and much more. The businesses churn guests daily and requires real time daily decision making. As we look toward 2022, what should we look at? Before we start, I’d like to encourage you to attend three events where I am speaking that are selling out quickly this month:

- California Travel Summit, Sept 12-14, Pasea Hotel Huntington Beach

- San Diego Women in Tourism & Hospitality, Sept 23-24, Four Points Sheraton San Diego

- The Lodging Conference, Sept 27-30, Marriott Desert Ridge, Phoenix, Arizona

Operational Analysis and Review

Now is a great time to determine areas where the property is performing well and areas that are in need of improvements. A careful review of both income statement and balance sheet will help hotel owners in important decision-making regarding their financial performance, renovation requirements, staffing and more. A detailed review of all management company or GM monthly reports is in order. Do you have all the data you need to win?

Property Repositioning Analysis

Hoteliers must regularly conduct analyses to determine how the hotel is positioned in the market from the perspective of the customer and from the perspective of the hotel’s management. Conduct a physical inspection of the property including front and back of house. In addition, a review of annual tax issues and opportunities is needed as well as a reduction of property tax caused by the pandemic.

Another area of review is STR reports, guest service scores, channel management review and electronic documents including the hotel’s website. There are times when a hotel must re-evaluate STR competitors and whether or not additional third-party reports are needed. Paying for reports that are not helpful is foolish but not paying for reports that are in fact helpful is worse.

Risk Evaluation

Additional hotelier responsibilities include identifying key hotel risks and developing strategies to mitigate their effects. Often times, there is no manager on duty at hotels or no plan in place for handling emergencies. Both of these conditions could present a challenge when an event takes place. These events can include medical emergencies, public disasters and active shooters as well as a plethora of unplanned events. A well-trained staff is paramount to success operationally and also helps avoid disasters and litigation.

Evaluating potential investment returns and conducting a detailed analysis of future market trends are both jobs that a good hotelier should be able to accomplish. Reviewing loan documents, assuring there are controls on hotel cash and purchases are in the wheelhouse of a good hotelier.

Check the Team

To operate a hotel today, the quality of the team is paramount. One operator cannot optimize revenues and expenses, make sales calls and handle the financial end of the business. Substantial due diligence is required to ensure the hotel has the right management, brand, renovation and business plan/budget. Hospitality has become extremely complex with revenue management, reputation management, distribution channel management, social media marketing, website development, ADA laws, risk management, human resource management and myriad technology changes.

It is still a great time to be in the hotel business, despite the pandemic. One of the fun parts of evaluating a hospitality business is the chance to install new state-of-the-art technology, institute new concepts and logistics and make changes that truly take advantage of the changing consumer profile. After this grueling summer, it is a chance to meet with the team, thank them for their hard work and give them a gift card, bonus and/or luncheon or ice cream social. If they stayed with you through this summer, they deserve it.

I leave you with a thought about what inning we are in as many industry pundits like to use the baseball game analogy – prior to the pandemic, we were in the 9th inning, going into extra innings. The game got stopped due to rain, er, Covid-19. Today, it is a new game, top of the first inning. Build a solid business plan and budget over the next month or two! May we raise our glasses to a stronger than expected finish to 2021 and a great 2022!

Success in the Summer of ‘21

How To Welcome Post-Pandemic Travelers Back Into Hotels

by Robert A. Rauch

*This article was first published on Hotel News Now in June 2021

The venerable hotel industry has been completely overturned during the past 15 months. We will have to create a very different strategy to outperform the competition this summer. What are the dynamics of hospitality industry competition today and how can we put together a winning plan in time for the Summer of 2021?

Today, a digital marketing strategy is an industry imperative and critical business solution in this digital age. Platforms including Facebook, Instagram, and Twitter allow hotels and restaurants to engage guests and offer a highly personalized level of customer service than before. These social media profiles are a key element that impacts organic search rankings for our business. Adding in great sales strategies that include hybrid meetings and “Zoom” like calls, public relations action plans and digital promotions that are impactful and measurable will help solidify our marketing efforts.

The Post-Pandemic Traveler

We’ve seen a quantum shift from hospitality as an art to hospitality as a science with the advent of digital marketing and now, we have the post-pandemic traveler. In the hospitality industry, knowing our guests’ demographics and spending habits can help us formulate marketing strategies and optimize profits. This information can be organized and integrated in databases that can then be tapped to guide marketing decisions that can assist in building predictive customer-behavior models that aid in decision making. It has been perfected for our industry by Kalibri Labs or you may mine the data in-house. So, what does today’s customer want?

Sustainability is often overlooked because it is such a broad term. Simply, it means, “meeting the needs of the present without compromising the future.” It can be a differentiator. The customer of this past year wanted a great rate to get away. But the discerning customers that will come this summer want to know that we care about the environment, treat our guests with respect and are easy to find. Knowing a customer and providing “wow” customer service earns us loyal customers and creates customer equity. This is even more important now that guests have returned to travel and may or may not have returned to their former hotel of choice.

The 6-Step Shortcut to Success

This can be implemented in one week if carefully orchestrated:

1. There are fewer employees willing to work in our industry now and we must update our personnel policies and orientation checklist and ensure compliance with our laws. Establishing training protocols, labor forecasting and scheduling systems are helpful. A good training program is paramount and includes the Four Step Method – preparing the worker by explaining the tasks, showing them how to do those tasks, allowing the worker to demonstrate understanding of the tasks and then providing feedback.

2. A Maintenance Checklist contains a comprehensive list that identifies each fixture, piece of furniture and equipment in the guest room. Twenty-five percent of the rooms should be inspected for necessary repairs each month of the year – this ensures that every room will be completely checked three times a year. If used in conjunction with a “deep-cleaning” program, every room should be maintained in near-perfect condition.

3. Atmosphere in the food and beverage area must be checked daily for lighting, background music, cleanliness, and service staff experience. Menu design for appearance and profit, purchasing systems to ensure quality, and cost control and pictures of food items and recipes for kitchen team members are all critical. Keeping all transactions contactless is the preferred way now.

4. Sanitation is perhaps the biggest concern of travelers today. Using disinfecting cleaning supplies coupled with diligence and training will keep our public spaces clean for the front and back of the house. When a guest walks into our hotels this summer, they will be pleased to see some of the benefits of the pandemic like impeccably clean lobbies and guest rooms yet no signs that say “guests must wear a mask.”

5. A great website that appears just as well on mobile devices, coupled with a social media platform presence will keep us on top of today’s digital nomad as well as those families who have not seen each other in over a year.

6. Revenue Management success will come from abandoning any reliance on artificial intelligence. These revenue management systems rely on history. What kind of history might we possibly have?

On again, off again travel restrictions, no business travel, no group business – go with your gut now that corporate business has been replaced with leisure! Raise those rates to meet pent up demand and if your revenue manager says something that doesn’t make sense, question it!

Let’s get our PPP loans forgiven, earn some tax credits and manage cash for profits instead of survival – to a phenomenal summer, one that will give us a shot in the arm that we will enjoy rather than a shot that protects us from a virus!

The Current State Of The Hospitality Industry

Where is the Hospitality Industry as of Spring 2021?

Current conditions in the state of the hospitality industry include leisure travel, employee challenges and reinvented guest programming.

While I do not know how we are going to pay for the government spending plans, I do know that in the short-term, we will see huge growth in gross domestic product with some forecasters projecting over 6% for this year. Lenders are back in the game and traffic on the roads seems to me like an increase in business overall. To date, all of the hotel business, by and large, is leisure business. Longer weekends have been created by travelers who are working remote on Fridays and Mondays.

Leisure Travel Demand

What is missing from the travel growth is still business travel, group meetings and international travel. Those hotels and markets that rely on these sectors are still likely a year away from a meaningful recovery. The pent-up leisure demand is here to stay due to consumer confidence.

This is based on “revenge travel” as well as savings and vaccine success to date. Business travel will begin to improve this fall but there will be some travel budget cuts from many companies. Group and convention business will be based on meeting restrictions in each market area and international business is a year away. If business is generally coming back, what is not? Employees.

Employees Challenges

I have been in the hotel industry over 40 years and have never seen the employment challenges we have today. Did the pandemic do this to us? It’s not that simple. In March, 2020, I had the opportunity to meet with all of our employees at a meeting. I called the meeting as soon as the pandemic was announced to advise our team of what our plan was. Unfortunately, we furloughed all line employees on that day.

Having been through myriad crises including fires, bomb threats, etc. I still felt shocked that I had to let our staff go. We had no revenue at all so I had a fiduciary responsibility to make the tough decision. This has not been a fun ride.

Retention

Fast forward a little over one year to Spring 2021 and now we are struggling to bring back those same employees. Some of those employees sought employment in other industries. Others found jobs at hotels that had recovered more quickly like limited-service hotels in suburban markets that had felt less pandemic impact. Others were afraid of the virus due to underlying health concerns, some chose unemployment and others had child-care responsibilities due to closed schools.

To succeed with our most valuable assets, we have to use caution to not overload our employees with extra responsibilities without rewarding them. This might be a good time for nice bonus checks and raises for those who have worked hard for the entire pandemic. With many other industries offering better benefit packages and salaries, we need to compete with these industries and look to become more effective and efficient. As Peter Drucker explained years ago, there is a difference between these. “Efficiency is doing things right; effectiveness is doing the right things.”

Reinvented Guest Programming

We must change the way we take care of our guests. It’s not less service, it is more of what they want. As an example, some guests want daily housekeeping. If we have to charge for that, either in the rate or as a surcharge, that is okay. Reorganizing our priorities is not a sin. Doing nothing is dangerous.

Let’s use technology and reorganization to become more effective. A good example is providing meeting planners with a hybrid tool for meetings. We are investing in Cvent to drive more small meetings business and Zoom to provide the technology needed to host meetings.

Technology

Technology vendors can help us in many ways and while technology will not replace jobs, it can reduce the load on management. In our case, we have outsourced accounting, human resources and revenue management. All of those tasks were taking managers away from their responsibility to ensure that guests receive service. Kalibri Labs adds huge value to revenue management and analytics.

Guest Interactions With Hotel Managers

I have found our managers are now on the frontline, unburdened with sitting at their desk keystroking rate changes, suffering through paperwork overload and crunching numbers to get income statements done. It is time for us to be creative about our future. Let’s talk to our guests and find out what each of them wants today. We have decided to provide more things to do for our guests such as:

- Beer, wine and liquor tastings

- Happy Hour programming with great appetizers from our chef

- Unique grab-and-go product offerings for breakfast, lunch and dinner

The bottom line is that we must ensure that we optimize revenues and expenses to return to profitability. We are a great service industry that can outperform short-term rentals, overcome new supply and adapt to changes in technology and market trends. To the recovery!

The Return Of Business Travel

*Originally published on March 24, 2021 at Hotel News Now

When Is business travel really coming back? Many corporate executives had all their meetings online in 2020. In 2021, we believe that will change soon due to the pace of vaccines, decline of COVID-19 cases, and negative impacts of closed economies. Regional sales trips are beginning again and airport executives suggest that business travelers are coming back. But when will this segment really return? Realistically, look at Q4 of 2021. Q2 will see an uptick, Q3 will be all about pent-up leisure demand and Q4 will see a strong return of business travel.

Companies have been able to conduct business online with improved online meeting technology however, there is no reason to believe that these meetings will continue online much longer. Certainly, our opinion is that a team that gets to break bread together will be more closely aligned than a team that uses technology for 100% of their meetings.

Hybrid meetings will reduce the amount of corporate hotel use which may be a lasting factor. With the advent of technology that provides diagramming of meeting rooms for distancing, safe meetings can return more quickly. Cvent provides software that we use to lay out a meeting room for each of the ever-changing state laws.

We believe that when the convention segment comes back, it will come back vigorously. Event sponsors do not want to pay $10,000 or more to be part of an online event. There might be a different approach to attendee participation as well as the serving of food and beverage and person-to-person interactions will come back beginning in Q4 and will grow quickly in 2022.

STR and Competitive Sets For Business Travel Analysis

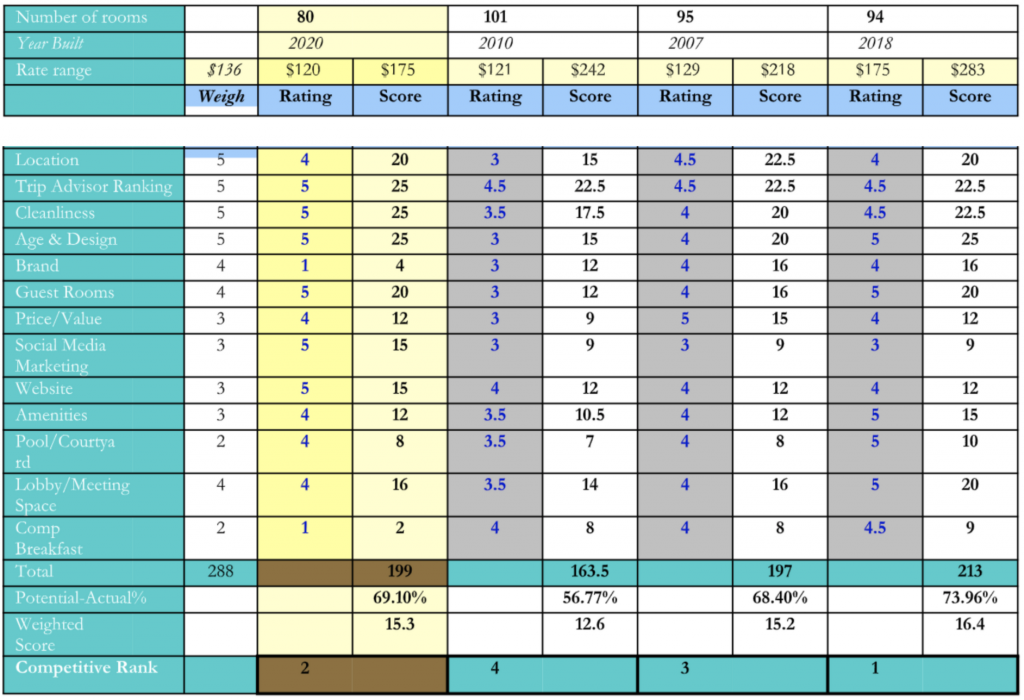

It might be time to revisit and if necessary, change your STR competitive set. We like to have a beauty contest among our competitors – which property looks the best, has the most up-to-date furnishings and appeal, and has an amenity package that meets today’s COVID standards. We will rate each hotel in the comp set by features that are important and weigh the features as appropriate. While we have been doing this for 30 years or so, we often change the components. Much of this analysis requires a site visit to truly get a feel but some must be evaluated online. Below is one you can use – note that some features might be stronger benefits to some markets and market segments so we weigh them accordingly and we limited the set to four hotels for space purposes only:

Revenue Management & Marketing Trends

Today, it is more critical to build a base so that we can drive the average rate after the base is filled. Taking a healthy in size, low-rated piece of business might be exactly what you need to do to shrink the size of the hotel and drive that rate. A good revenue manager can analyze what type of guest is ideal for that base as well as what type of guest is appropriate to pursue after the base is established. Kalibri Labs can help with that long-term analysis.

Digital marketing and analytics will play a role in everything we promote today. Understanding how the search engines work and what we must do with our websites today is paramount to moving the needle online. Our needs going forward will likely include an SEO (search engine optimization) expert, a content writer, and an overall digital marketing generalist. We will need a salesperson who not only understands analytics but can make virtual sales calls as well as traditional ones. And we will need a lean, well-trained organization to make profits in the near term.

Other trends that are occurring include:

- Breakfast special packaging that cuts moisture and retains heat

- Google reviews have been gaining ground on TripAdvisor

- Cleanliness and sanitation will continue to get kudos from guests

- Room service may largely be replaced by delivery of high-quality, packaged foods

- The biggest trend? Finding employees – that’s right, other industries have scooped up some of our good ones, some are on unemployment and not ready to come back and others are not qualified, according to some HR executives. But we will survive and thrive!

Best of luck in Q2, 2021!

Turn 2020 Profit Losses into 2021 Wins For The Hotel Industry

by Robert A. Rauch

rauch@hotelguru.com

*Article was first published on CoStar on February 17th, 2021

How To Make 2021 Our Best Year

Q1 of 2021 is not going to be profitable, fun or exciting for us in the hotel industry. The goods news is Q2 will come up quickly and having been through six recessions in hospitality, all the signs of a recovery are finally here. Given the significant impact of the virus on our economic, physical and mental health, I am offering a few sentences of my personal plan to recovery; we’ll dive into the following areas below:

- Cash Flow For Hospitality Industry

- Marketing, Sales & Revenue Management

- Technology To Improve Hotel Revenue

Whether we operate a hotel, restaurant or tourism-related business, our numbers are likely depressed sharply this past year. So, before we jump into some quick fixes, we must take some slow, deep breaths to slow our breathing down and to appreciate ourselves. Without a positive attitude, a return to normal is difficult and it will show up in our attitudes toward that very important team.

Exercise will not only help our immune systems but it will also reduce stress. It is time to put the virus behind us and prepare for a robust recovery. Once the weather turns, there will be many who have been vaccinated, others who will have gained immunity, and many of them and others will change their behavior. Whether it’s leisure travel or the digital nomad trend, travel will return. No, employment and spending will not be at 2019 levels and travel will not be strong until summer but it will pick up nicely by April. It is time to be optimistic and to prepare to win the market share war and turn losses into profits.

Cash Flow

Our government has approved and is sending out money in the form of PPP2, round 2 of the CARES Act. It is coming in this month, February, for those who applied but getting that money forgiven requires 60 percent of it to be used for payroll. It is hard to hire our staff back unless we have significant maintenance, cleaning or other work to provide them or are willing to go through some additional training before we get busy and actually need more employees.

An asset management review of our property will indicate plenty of opportunities to spend and training and development is paramount to coming back strong. Most likely we have negotiated better deals with vendors and cut out non-essential activities. There is no need to go back to 2019 spending. Keep our organizations flat and resist hiring middle-management as our employees will shine and be able to grow if trained by top management now.

Marketing, Sales and Revenue Management

If we have not tried digital marketing during this recession, now is the time to start. A great newsletter, coupled with sharp digital/social media strategies can set us up for success quickly. Pay-per-click will come back strong and event marketing will now be largely hybrid events.

Our clients need to have events and we can make it easy for them to host with some basic knowledge. Optimizing our web sites, online channels and Cvent profile are all critical to get started. When it comes to implementation of a hybrid meeting, distancing in floor plans, sanitization stations and video/AV technology ensures that the clients know that we have the ability to pull off the meeting.

Sales calls are not in-person today, but Zoom, Cisco Webex or Go To Meeting make these calls easy. Sure, our sales team will have to know what industries are ready to book like healthcare, construction and government but life sciences and communications technology will also come back soon. The last part of the sales puzzle is knowing what the guests and clients want – safety and security are both critical.

Now that our sales people are cranking up the volume, revenue management comes back. There haven’t really been any revenues to manage but there will be soon. And what a perfect time to break down the silos of these three jobs of marketing, sales and revenue management.

Tools & Technology To Improve Hotel Revenue

If we have already flattened the organization, a good general manager can manage all three of these functions as one team, perhaps one person! If you’re looking for some new tools to add to your 2021 strategy, here are a few I use and recommend.

- STR – Hotel market data for benchmarking

- Kalibri Labs – Hotel performance benchmarking for revenue management

- Cvent – Event management technology

- TravelClick – Sales & revenue management reports

- AirDNA – Short-term rental data & analytics

Put them in our budgets and have all of them send us some reports to look at. It is amazing what breadth and depth of information is readily available.

We all know that our budgets have been wrong for the last 10 months but now is the time to revise our 2021 for reality. Stay lean, create a game plan, and make our top people do the work in the trenches. When we are ready to put that PPP2 money to work, our teams can train the rookies to become rock stars. Enjoy 2021—I guarantee it will be way more fun than 2020!

Robert A. Rauch, CHA, is an internationally-recognized hotelier, CEO and founder of RAR Hospitality, a leading hospitality management and consulting firm based in San Diego. Rauch has more than 35 years of hospitality-related management experience in all facets of the industry.

Vision 2050 – 2nd Edition

The Recovery Year For Hotels

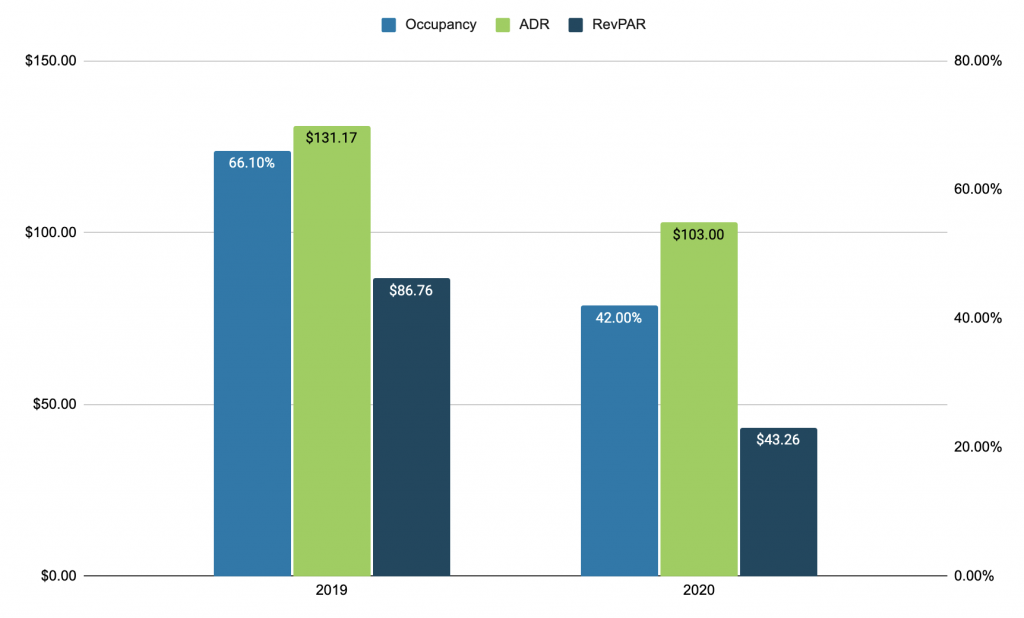

The final U.S. lodging industry numbers for 2020 came out and RevPAR literally finished at half of where it finished in 2019—that’s right, half! Occupancy was 66.1% at $131.17 average rate and RevPAR of $86.76. 2020 finished at 42% at a rate of $103.00, RevPAR was $43.26. The impact to the bottom line is easy to see in our bank accounts as breakeven has always been thought to be close to 60% occupancy but many forget the importance of rate to that equation.

Travel Demand

Travel Demand

How and when do we recover? The when is certainly up for debate but most pundits are focused on 2023 or 2024. The how is to understand where customers are coming from—not geographically, but through what system. While geography is critical for targeting, these guests are found on websites that track customers showing interest in travel.

Google has debuted new tools to help destinations and hotels use search data to identify and analyze travel demand. These tools are Destination Insights and Hotel Insights, and are available to any business, including non-advertisers, on the Travel Insights with Google. The website is aimed at helping the sector better understand the pent-up demand and leverage insights from key data led tools for businesses to position themselves for recovery. These trends will be based on user search data on the tech company’s search engine.

Another area of interest might be vaccinations – those who receive them may travel sooner—I know I will! Healthcare workers will be ready for a break later this year and the 65+ set has been ready for almost a year! Keep in mind that despite the dire forecasts, if you are in a market where leisure travel is desirable and we vaccinate 1 million per day, 50% of citizens will be vaccinated by summer.

Building Your Online Presence For Marketing

Today’s digital marketing must include a robust approach to Instagram, Facebook and any social media where we can get the word out about our business. Instagram has a feature called Guides that might fit for certain hotels and destinations.

Your marketing efforts should focus on your niche, what sets you apart, how you can be there for your guests, and promotions to excite your guests to complete your direct booking. Here are a few tips to keep your online presence strong.

- Keep your website up to date. This means photos, promotions, cleaning protocols, etc.

- Add fresh content to please the search engines. Blogs are a great way to do this.

- Speak to your guests to be relatable. Social media and review sites such as TripAdvisor should be your go-to for public-facing communication.

Average Rates & OTA Relationships

When talking about what kind of occupancy and average rate we will see in 2021, there are conservative approaches due to current pandemic restrictions and more forward-thinking and aggressive forecasts that assume pent-up demand by summer of 2021. Either way, consumers will likely be price-conscious.

That doesn’t mean we can’t drive rates during peak periods but remember how many hotel rooms are coming back on the market from being closed and opening new and how many short-term rentals are on the market. It’s going to be a little while before we can just raise our prices to 2019 levels.

Many travelers have less money and less job security, and are changing the way they shop for travel, so use caution when raising rates this winter. Be a revenue management/rate leader if you have a strong asset but remember to include short-term rental data (easily obtained from AirDNA) as well as all channels. Many of us have a love/hate relationship with OTAs. Try some love as the OTAs have strong marketing budgets and are very smart about where they spend those dollars.

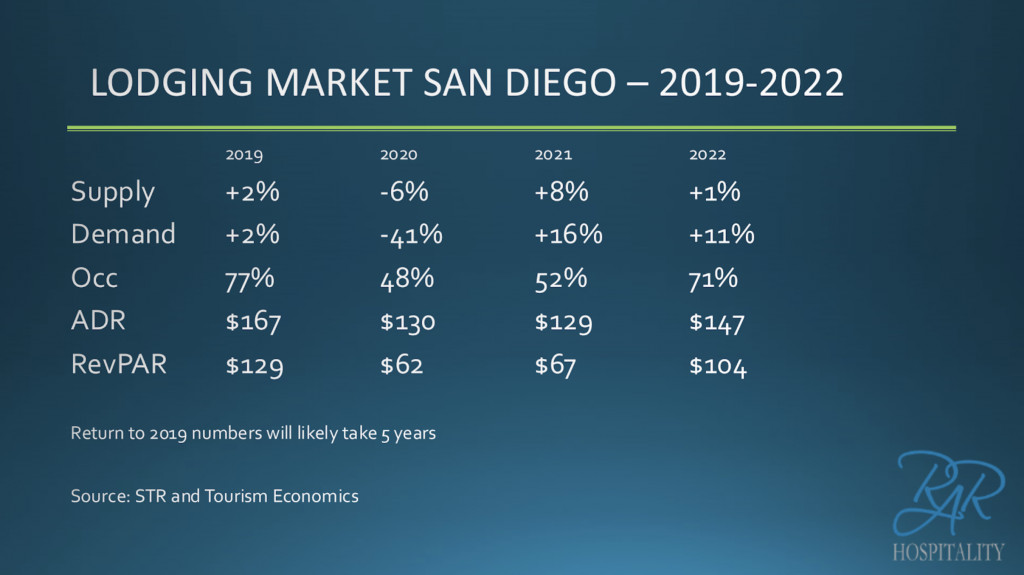

We might look at some of Google’s programs like Pay Per Stay as you do not pay unless the guest stays along with travel intent data, part of the aforementioned Travel Insights with Google platform. In that we are based in San Diego, we looked at San Diego’s forecast from Tourism Economics and it doesn’t look rosy:

I am an eternal optimist who thinks that if the U.S. is at 50% occupancy and San Diego is normally 10 points higher, San Diego will hit 60% this year. But California has crippling government mandates and having any hopes up for group or corporate business might prove irresponsible. The bottom line is to preserve cash as if the virus stays and do everything in your power to drive demand. Best of luck in 2021!

In case you missed Vision 2050 – 1st Edition, check it out here!

Vision 2050 – 1st Edition

The next 30 years begins with COVID-19 recovery. What does that look like? We pick up the pieces that were cracked, torn apart and ravished one by one. We will review demand, those elusive customers who are either mandated to stay at home, are afraid to travel or were planning to attend an event that was postponed or cancelled. We’ll discuss challenges we see on the horizon and review the economy, what guests are looking for, what hotel recovery may look like and the future.

Short-Term Outlook

Good times are ahead for those with about six months of patience. We will have a very soft Q1 despite the PPP dollars that will be coming in, followed by an improved Q2, a robust Q3 and strong growth in Q4. It will not be because our political climate is favorable – it is not. Governor Newsom in California and Governor Cuomo in New York have fooled the public into thinking they are doing a good job on both the health of residents and the economy. They are not doing us any favors on the economy and have not protected us much better than states that are open.

We must balance the health and economic needs and provide better testing, protect the vulnerable and open the economy. The Biden Administration must continue good programs and adjust in areas where they want to improve. The economy was not the problem, the virus was and remains the primary obstacle to economic recovery.

What Are Guests Looking For?

Guests will continue to want a contactless environment going forward. Digital check-in and keys, increased cleaning protocols that provide a commitment to cleanliness, fitness center and pool sign-in, in-room amenities and housekeeping service provided on request only and limited capacities are here for a while. Room to breathe, safety-first policies, a renewed focus on the customer and on sustainability will go a long way in pleasing guests.

Using hotels as short-term rentals/apartments, offices and families staying with kids who are learning remotely will continue for another few months or more. They will be replaced by corporate and group travelers beginning in the second half of 2021.

Competition From Short-Term Rentals

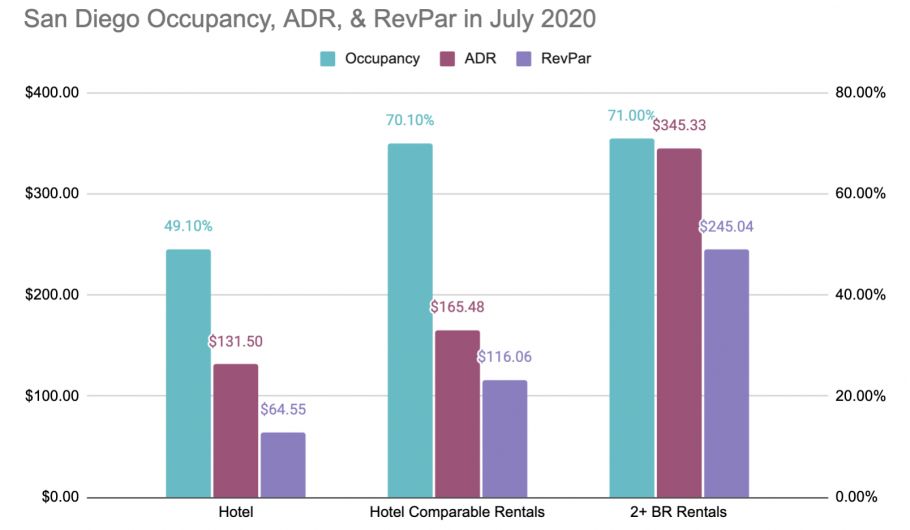

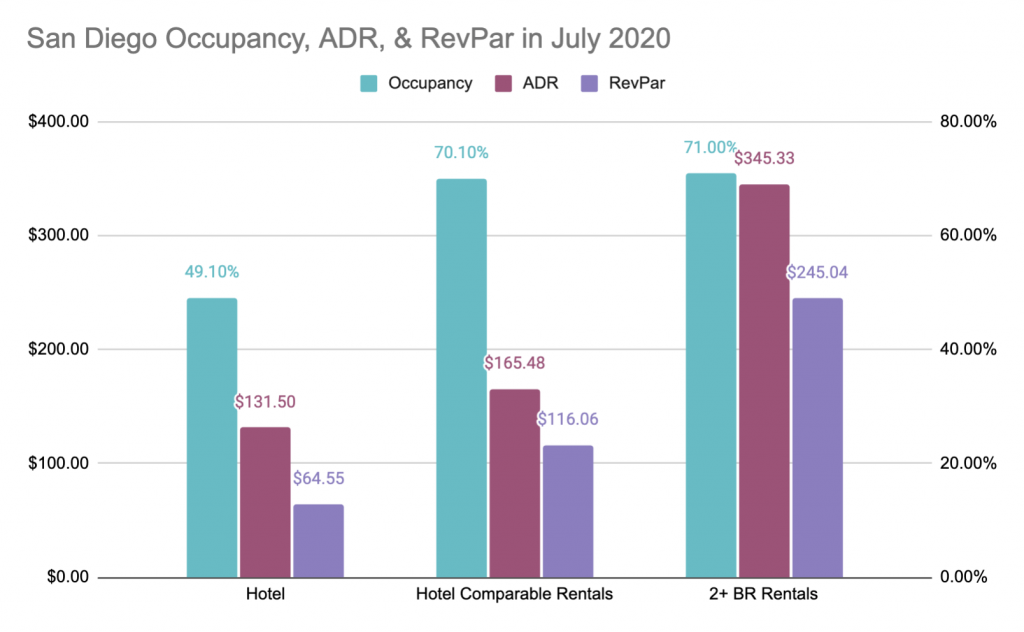

AirDNA, the leading provider of short-term rental data and analytics, analyzed room nights to show that occupancy and average rate declined much more severely among hotels than Airbnb hotel comparables (studio and 1-bedroom). As an example, looking specifically at the San Diego market, one that has a strong short-term rental market (STR), here were the results for July, 2020:

Data sourced by AirDNA and STR

Short-term rentals reported higher occupancy, ADR and RevPAR compared to hotels for the month of July. Hotel occupancy declined from 90% to 50% while rates dropped from $180 to $130. That RevPAR decline is $162 to $62, a 62% decline. During that period, RevPAR declines at hotel comparables (short-term rental units that are studio or 1-bedroom) was only 14%.

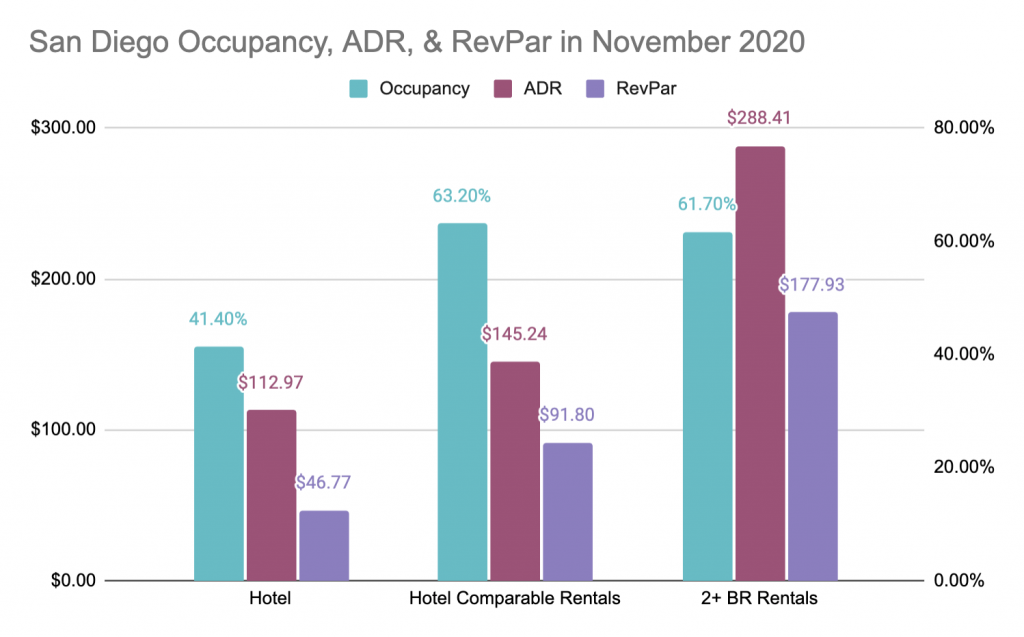

The bottom line is that we have lost market share to STRs in a big way. Still not a believer? Let’s look at November performance below.

Data sourced by AirDNA and STR

Hotel RevPAR declines were 50% while STRs were up 16%. The addition of new supply, coupled with loss of market share from STRs will put pressure on hotel performance going forward.

Challenges Facing the Industry in 2021 and beyond

Short-Term Rentals are not the only challenges on the horizon. We need a strong hotel recovery from COVID-19, a return of the business traveler, a return of meetings and a return of the international traveler. Further, new supply that was in the pipeline will continue to open and for at least another year, large convention hotels will be competing with smaller properties every single day, keeping rate growth down. The customer will be calling the shots unless we can differentiate ourselves. This will require both some top-notch digital marketing and new operational service levels that wow the guests with sanitization, cleanliness, creativity, value and more.

Yes, we can face these challenges head-on. Enhanced hygiene tools can differentiate one hotel from another and the hotels from vacation rentals. Vaccine delivery will have an enormous impact on travel. First, travelers will feel comfortable making trips they would not even consider before taking the vaccine. Second, corporations will allow their team members to travel to events, conventions and on sales calls. Third, consumer confidence will jump to new heights due to pent-up travel demand. To much better 2021!